Digital rails for climate finance

We’re building infrastructure that makes it easier for carbon credits to be bought, sold and retired.

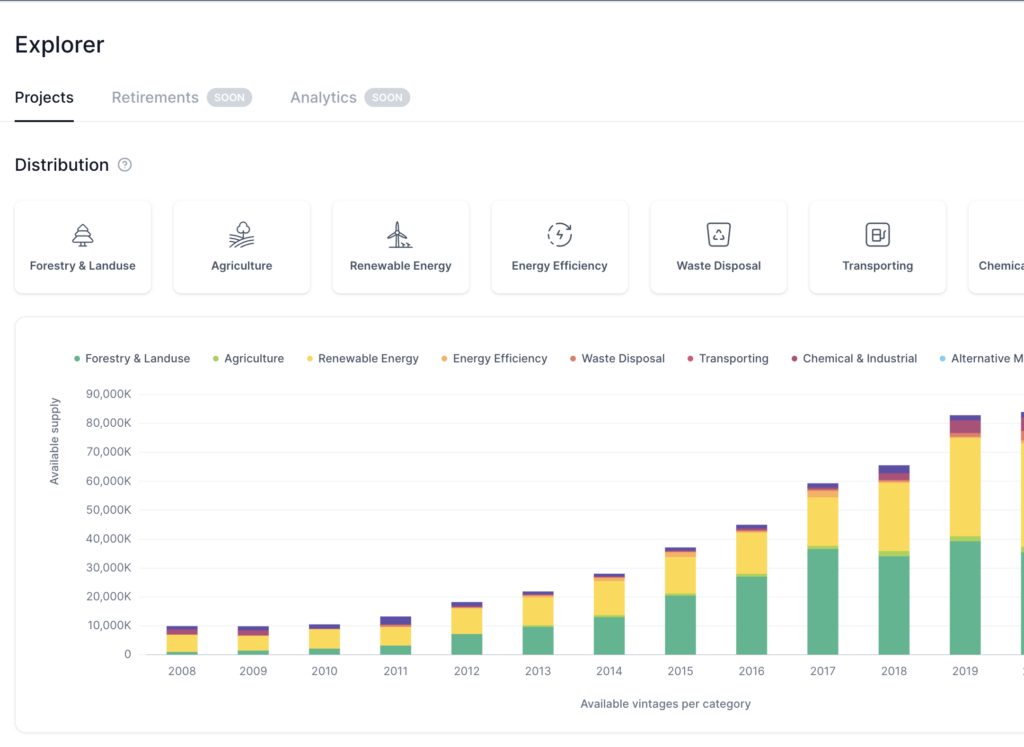

Toucan addresses two key bottlenecks in Carbon Markets

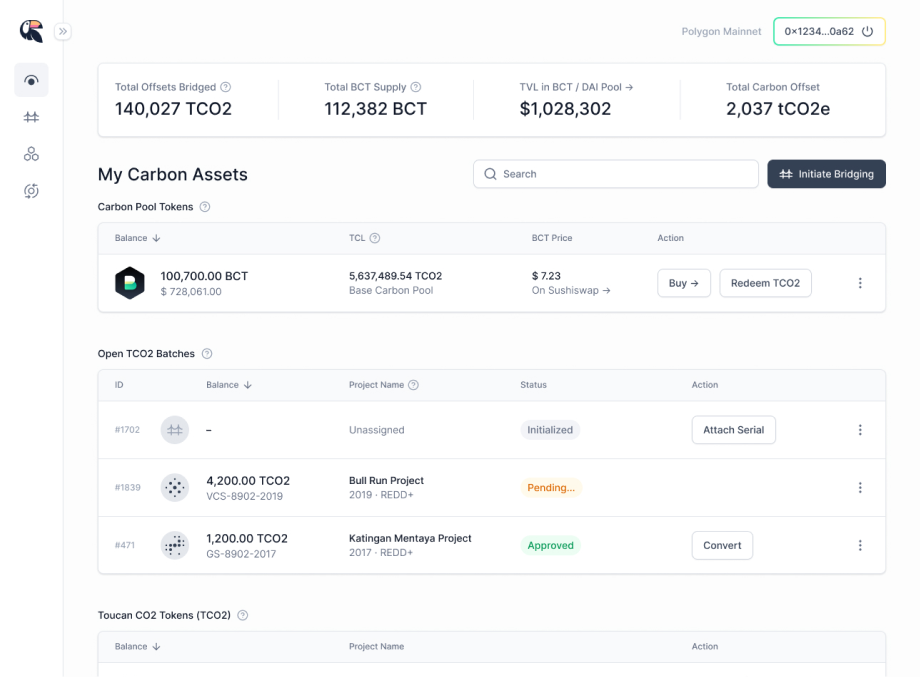

Credit Liquidity

Toucan's infrastructure supports a liquid market where project developers can instantly sell their credits to mobilize capital. This allows these key actors to scale their impact, while an efficient market price discovery.

Risk Assessment

Our data layer lets buyers comprehensively assess risk by providing deep visibility into information about credits origination, monitoring and market performance. This allows buyers to support projects with confidence.

The numbers

Post-launch, Toucan’s infrastructure rapidly scaled to support $4 billion in carbon credit trading volume. Today, we represent 85% of all digital carbon credits.

Carbon trading volume

Carbon credit retirements (tonnes)

Carbon credits uploaded to our platform

Climate projects

What we offer

Our product suite provides key insights and tooling for project developers, credit buyers, and everyone inbetween. All carbon market actors can use our tools to smoothly navigate the complex landscape of climate finance.

Instant settlements

Project developers can directly tap into new and established demand sources, while market participants move beyond over-the-counter trades.

Data transparency

Everyone can view comprehensive information of individual carbon credits, including when and how often they have been transacted, and for what price.

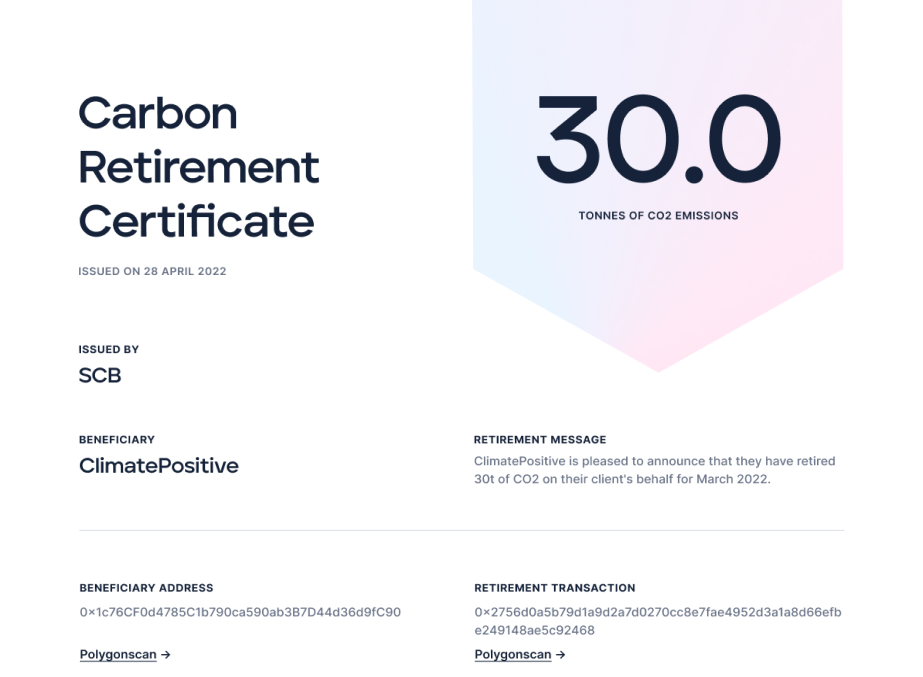

Verified retirements

Credit buyers can confidently perform retirements in hours instead of months, knowing that their climate investment delivers the impact they’re aiming to achieve.

Who we're collaborating with