Introducing Open Carbon

Imagine impact claims that you can trust.

Discover a world where carbon finance is inclusive, transparent, and efficient. Where enhanced carbon credits deliver trustworthy data to anyone, at any time.

Carbon markets' biggest challenges

Carbon markets are not set up to scale at the speed and dimension needed to address the climate crisis. There isn’t enough transparency in the market. Developers struggle to showcase the impact of their projects, and money doesn’t flow to those that need it most. The resulting lack of trust causes many actors to steer clear of making environmental impact claims.

Fragmentation

Buyers have limited ways of comparing which credits they'd like to purchase.

Little transparency

It's challenging to identify fair pricing for assets due to lack of transparency.

Lacking data

Risk assessment is difficult because data is absent or hard to interpret.

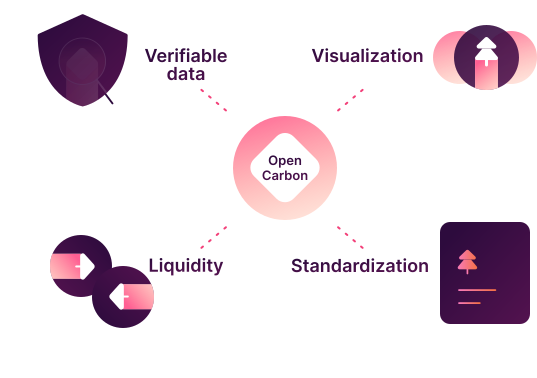

What is Open Carbon?

Open Carbon is a framework that makes carbon credits transparent and easy to access. It guarantees that an individual credit has a minimum level of trusted data directly embedded into the credit, and rebuilds trust between project developers, credit buyers, brokers and other VCM stakeholders.

Through standardization, carbon credits can be commoditized, while their unique metadata is preserved. Our technical infrastructure allows for instant settlements.

Credits are standardized across different carbon registries. This allows users to easily compare and discover suited credits.

Important data from different sources is directly embedded into the credit. This includes dMRV, rating data from independent organizations, origination-, issuance and transaction data, as well as price points.

Key information is aggregated and made easily accessible in one place.

Open Carbon benefits

By bringing key information into the open, market participants can make informed decisions on the true value of assets.

Each Open Carbon credit’s detailed transaction data can be viewed by everyone, including information on the credit price, time of purchase and number of previous transactions. All of this updates in real time.

Open Carbon’s increased transparency ensures that prices accurately reflect the market’s supply and demand dynamics.

Open Carbon aggregates environmental claims from a broad variety of carbon standards, and attaches third-party ratings, expanded origination and digital MRV data and more to each credit.

Users can freely compare Open Carbon credits’ dynamic data across different standards and methodologies.

All of this additional information is embedded into the digital carbon credit, meaning it goes everywhere the credit does, no matter how many times it is transacted.

This standardization counter-balances fragmentation and increases market efficiency.

With one click, anyone can query transaction information of any carbon project.

Data points include how actively a project is being traded and what proportion of issued supply is still on the market or already retired. It also shows at which prices a credit was bought and sold, thus helping purchasers and sellers evaluate a fair value for their assets.

This level of detailed information leaves buyers feeling confident that they’re purchasing a high integrity carbon credit.

Every open carbon credit is enhanced with valuable data provided by organizations across the market, from independent rating agencies and relevant news articles to information provided by verifiers and insurers.

This data is directly attached to each Open Carbon credit and dynamically updated with each transaction or surfacing of new information, up until the credit is retired.

This improves confidence on the demand side, as the effective evaluation of the risks attached to a climate investment is only possible with sufficient information, conveniently aggregated in one single place.

The journey starts today

Phase 1: Visualization

Phase 2: Liquidity

Phase 3: Standardization

Share your feedback on phase 1.

Join our beta cohort to share your feedback on our Open Carbon Explorer – a new tool that helps visualize, discover and compare credits across environmental markets. Our beta cohort is an exclusive group of VCM stakeholders with early access to what we’re buidling. Your interactions and insights will shape the direction of the platform, and inform the future of Open Carbon.